Source: RealEstate

Think of some of the world’s biggest brands: Nike, McDonald’s, Coca-Cola, Apple. With what do you associate them? Are they positive associations? Now consider, do you trust them?

Brand trust is a measure of how customers feel about a brand in terms of how well the brand delivers on its promises. Trust is an important measure for any organisation, large or small.

Whether or not customers trust a brand can be the difference between choosing that brand’s products or services over another.

In Australia, Woolworths held the title of our most trusted brand for three and a half years. But recent cost of living pressures have put supermarkets in the spotlight for all the wrong reasons.

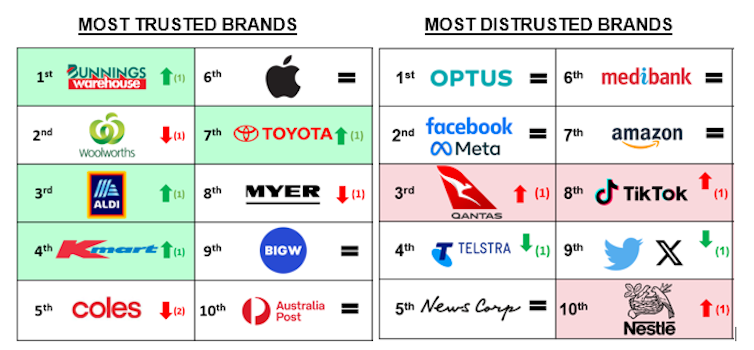

Roy Morgan Research’s most recent trust rankings show Woolworths has slipped to number two, handing its crown to hardware behemoth Bunnings.

It’s clear that trust is fragile and can be quickly squandered when brands lose touch with those they serve.

So what makes us trust a brand in the first place? And why do we trust some more than others?

What makes us trust a brand?

According to customer experience management firm Qualtrics, brand trust is

the confidence that customers have in a brand’s ability to deliver on what it promises. As a brand consistently meets the expectations it has set in the minds of customers, trust in that brand grows.

There are many ways to go about measuring brand trust. A typical first step is to ask lots of people what they think, collating their general opinions on product quality and the brand’s customer service experience.

This can be strengthened with more quantifiable elements, including:

- online ratings and reviews

- social media “sentiment” (positive, negative or neutral)

- corporate social responsibility activities

- philanthropic efforts

- customer data security and privacy.

Some surveys go even deeper, asking respondents to consider a brand’s vision and mission, its approaches to sustainability and worker standards, and how honest its advertising appears.

Is this a real and useful metric?

The qualitative methodology used by Roy Morgan to determine what Australian consumers think about 1,000 brands has been administered over two decades, so the data can be reliably compared across time.

On measures of both trust and distrust, it asks respondents which brands they trust and why. This approach is useful because it tells us which elements factor into brand trust judgements.

Customer responses about the survey’s most recent winner, Bunnings, show that customer service, product range, value-for-money pricing and generous returns policies are the key drivers of strong trust in its brand.

Here are some examples:

Great customer service. Love their welcoming staff. Whether it’s nuts and bolts or a new toilet seat, they have it all, value for money.

Great products and price and have a no quibble refund policy.

Great stock range, help is there if you need it and it is my go-to for my gardening and tool needs. Really convenient trading hours, and their return policy is good.

In addition to trust, there are three other metrics commonly used to assess brand performance:

- brand equity – the commercial or social value of consumer perceptions of a brand

- brand loyalty – consumer willingness to consistently choose one brand over others regardless of price or competitor’s efforts

- brand affinity – the emotional connection and common values between a brand and its customers.

However, trust is becoming a disproportionately important metric as consumers demand that companies provide increased transparency and exhibit greater care for their customers, not just their shareholders.

Why do Australians trust retailers so much?

Of Australia’s top ten most trusted brands, seven are retailers – Bunnings, Woolworths, Aldi, Coles, Kmart, Myer and Big W.

This stands in contrast with the United States, where the most trusted brands are predominantly from the healthcare sector.

So why do retail brands dominate our trust rankings?

They certainly aren’t small local businesses. Our retail sector is highly concentrated, dominated by a few giant retail brands.

We have only two major department stores (David Jones and Myer), three major discount department stores (Big W, Target and Kmart) and a supermarket “duopoly” (Coles and Woolworths).

It’s most likely then that these brands have been enjoying leftover goodwill from the pandemic.

As Australia closed down to tackle COVID-19, the retail sector, and in particular the grocery sector, was credited with enabling customers to safely access food and household goods.

Compared with many other countries, we did not see a predominance of empty shelves across Australia. Retailers in this country stepped up – implementing or improving their online shopping capabilities and ensuring physical stores followed health guidelines and protocols.

Now, with the pandemic behind us and in an environment of high inflation, the big two supermarkets face growing distrust and a public inquiry.

Lessons from the losers

After two high-profile disasters, Optus finds itself the most distrusted brand in Australia.

Its companions in the “most distrusted” group include social media brands Meta (Facebook), TikTok and X.

Qantas, Medibank Private, Newscorp, Nestle and Amazon also made the top 10.

The main reason consumers distrust brands is for a perceived failure to live up to their promises and responsibilities.

For example, worker conditions at multinational firm Amazon are seen by some consumers as a reflection of questionable business practices.

Other brands may have earned a reputation for failing to deliver the basics, like when chronic flight delays and cancellations plagued many Qantas customers.

Lessons from the winners

On the flip side, consumers have rewarded budget-friendly retailers with increased trust in the most recent rankings.

Aldi, Kmart and Bunnings have improved their standing as trusted brands, no doubt in part because they have helped many Australian consumers deal with tight household budgets.

As discretionary consumer spending continues to tighten, we may see a more permanent consumer shopping shift towards value for money brands and discounters.

Trust is a fragile thing to maintain once earned. As we move through 2024, Australian companies must pay close attention to their most important asset – strong relationships with those they serve.![]()

Louise Grimmer is a senior lecturer in retail marketing at the University of Tasmania.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Handpicked for you

Ishka reappears on NSW Fair Trading complaints register after VIC public warning

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.