According to Knight Frank Asia Pacific between 2009 and 2014 the total value of Chinese overseas investment skyrocketed from US$600 million to hit an estimated US$15 billion, with the thrust of this investment focused in the gateway cities of Australia, the US and the UK.

Australia witnessed the strongest growth in inbound real estate investment from China in 2014 at more than a 60% increase year on year.

Meanwhile, under the terms of the China-Australia Free Trade Agreement (ChAFTA) the threshold of Foreign Investment Review Board (FIRB) screening for Chinese investors targeting commercial real estate has been lifted from a comparatively trifling $54 million to a massive $1,078 million, in line with existing limits on private business investments.

It is no longer in question of “if” capital inflows from Asia are impacting our property markets, the questions should rather be “how exactly are they doing so?” and “to what extent?”

Here are four trends which became increasingly identifiable through the course of 2014.

1 – DEVELOPER CAPITAL FORCING UP CITY LAND VALUES

One outcome of the raising of the FIRB threshold is that Asian investment groups aiming to acquire Australian commercial property can, within reason, target any asset deemed to be attractive.

In the development space there have been several instances of Asian developers paying prices comfortably in excess of what is perceived locally to be “fair market value”, in certain cases 25 to 40% above what domestic developers might previously have been prepared to pay.

Having been swallowed up by China’s Dalian Wanda Group for a thumping A$425 million, the tired Gold Fields House office block at Sydney’s 1 Alfred Street (opposite the Cahill Expressway at Circular Quay) will be turned into luxury apartments with stunning views of Sydney Harbour.

The acquisition of a prime site in Erskineville in Sydney’s inner west by Hong Kong’s Golden Horse group for A$350 million was another landmark transaction, being the highest price paid to date for such a residential site in Australia.

It is important not to underestimate the potential scale of Chinese investment.

The state-owned Chinese property developer Greenland, constructors of the 600 unit Greenland Centre tower in Sydney’s Central Business District, is one such example of a behemoth group, with an annual turnover which comfortably dwarfs that of any Australian company.

The Greenland group sees “no ceiling” to the volume of funds it is prepared to invest in Australia, immediately declaring after the signing of the ChAFTA that agriculture assets would be targeted.

Moreover, purchasing power has increased as the Australian dollar has depreciated.

While Chinese developers can and frequently do add to the dwelling stock through residential development, land prices in the inner suburbs of Sydney and Melbourne are undoubtedly being pushed higher by Asian investment – and ultimately higher land values are likely to be built into the cost of the final product for the end user.

This dynamic is also resulting in substantial windfall gains for some vendors.

2 – APPROVED PURCHASES HAVE DOUBLED

The latest data from FIRB suggests that total approvals for foreign investment in residential property approximately doubled from $17 billion to $34 billion in 2013/14.

While the bulk of approvals continue to relate to new property at around 80% of the total (this $27 billion itself being a colossal 170% year-on-year swelling), the concentration of approved investment in Sydney and Melbourne is noteworthy.

Furthermore, the prior year comparative figures disclosed in the notes to the FIRB Annual Report showed that total approved investment in commercial real estate was double that of residential.

The sale of high-rise apartments has been one of Australia’s thriving export industries of the past half decade, with new developments in the three largest capital cities being fluently marketed via slick multilingual brochures and websites.

Increasingly assured of their ability to peddle apartments offshore, developers have proceeded to commence the construction of record volumes of high-rise supply, and pleasingly this trend is helping to add significantly to the aggregate dwelling stock.

My analysis has shown here previously that this will result in an oversupply of high-rise apartments in a number of capital city hubs around Australia, which will drive vacancy rates higher and place an equivalent downward pressure on rents.

Indeed, unit yields across several tracts of Brisbane have already discernably declined over the past 18 months, a trend which has sometimes been masked in the reported macro level capital city figures by the “newness premium” charged on pristine new rentals.

3 – RECORD CHINESE TOURISM SPEND

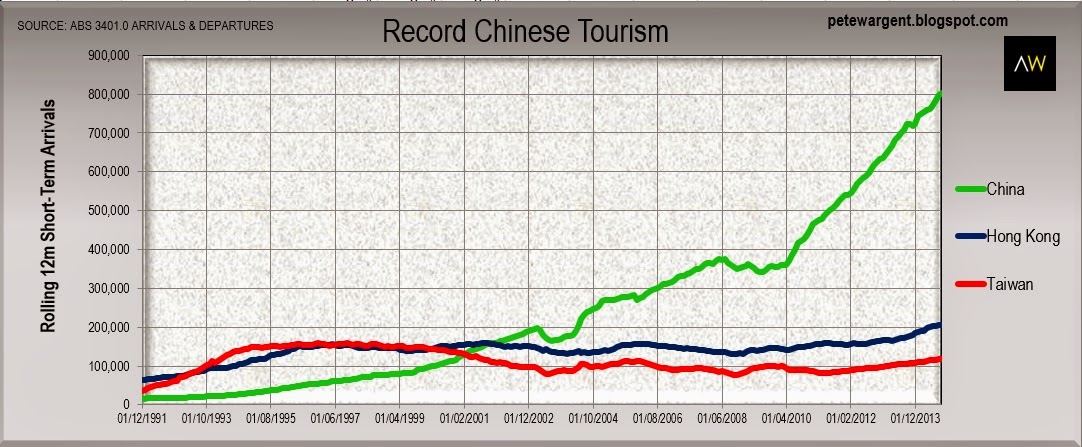

While there is no direct correlation between the impressively rebounding tourism sector observed in our international trade data and our real estate markets, record Chinese visitor numbers and tourism expenditure is inextricably linked to other longer term demographic trends, including the increasing popularity of Australia as a destination for Chinese capital.

The economic impacts of tourism are bothersome to identify and isolate, but the best “control” or bellwether capital city property market is that of Hobart, a relatively small city which has played host to record Chinese tourism spend over the past year.

My analysis has shown that while both employment and population growth has remained muted in Tasmania, the depreciation of the Aussie dollar has seen the local economy improve and Hobart has begun to record moderate housing market growth.

4 – CAPITAL FLIGHT FROM CHINA

I’ve deliberated long and hard on this point before making claims which can’t be substantiated or backed up with corroborative evidence.

Look, it’s happening, and dwelling price movements over this decade to date indicate where, that being our two most populous cities.

While the value of approved foreign real estate purchases may appear immaterial in the context of a $5.4 trillion housing market, it would be naïve to think that Asian capital is not having an impact at the margin, particularly in a market where annual housing finance domestically is measured only in billions.

In today’s more fluid financial markets motivated Asian capital can find (and is finding) its way to Australia, and in sentiment-driven markets where perception alone can move prices, incontrovertibly this matters.

PICKING WINNERS

Observers should not be fooled into think that one high profile FIRB intervention at a Wolsely Road address is representative of a government desire to repel Asian investment in Australia. It’s not.

As the mining investment boom unwinds and the Australian economy faces consequential commodity market headwinds, quite the opposite has been true, as evidenced by the detail of the ChAFTA and the promotion of the Business Innovation and Investment Visa (the subclass number “888” affirmation enough of the program’s intention).

The sale of Australian assets results in windfall gains for some, but distorts the markets adversely for others.

The government wants and needs Asian investment, and that is what it is getting, and there is evidently minimal capacity or desire to get involved in picking winners.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

This article originally appeared on Property Observer.

COMMENTS

SmartCompany is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while it is being reviewed, but we’re working as fast as we can to keep the conversation rolling.

The SmartCompany comment section is members-only content. Please subscribe to leave a comment.

The SmartCompany comment section is members-only content. Please login to leave a comment.